Global crude oil prices recorded a notable decline of over one percent in international markets, according to a foreign news agency. Following the drop, the price of crude oil slipped to around $60 per barrel, marking one of the sharpest single-day declines in recent weeks.

The fall in prices came after developments linked to Venezuela’s oil sector and fresh statements by the US President.

Demand Raised for Reduction in Packaged Milk Prices

Demand Raised for Reduction in Packaged Milk Prices Marriage Speculation Trends Again After Social Media Interaction

Marriage Speculation Trends Again After Social Media Interaction

US Signals Increased Oil Supply from Venezuela

After legal proceedings involving the Venezuelan president in a New York court, the US President announced that Venezuela would supply between 30 million and 50 million barrels of crude oil to the United States.

He further stated that American oil companies will invest in Venezuela, becoming directly involved in the country’s oil industry to ensure stable global supply.

Oil Revenue to Remain Under US Oversight

According to the US President, revenue generated from Venezuelan oil sales will remain under American control and will be used in the interest of both nations’ citizens. He added that the crude oil would be transported directly to US ports, bypassing third-party routes.

Following these remarks, global oil markets reacted immediately, with crude prices falling by 1.4 percent.

Demand Raised for Reduction in Packaged Milk Prices

Demand Raised for Reduction in Packaged Milk Prices Marriage Speculation Trends Again After Social Media Interaction

Marriage Speculation Trends Again After Social Media Interaction British Rapper Announces Conversion to Islam During Live Stream

British Rapper Announces Conversion to Islam During Live StreamAnalysts Warn Prices May Drop Further

Energy analysts estimate that Venezuela’s stored crude reserves could be worth nearly $3 billion. If these reserves enter the global market, oil prices may face further downward pressure.

Despite holding the world’s largest proven oil reserves, Venezuela’s production has collapsed due to mismanagement and corruption. Output has fallen from 3.5 million barrels per day 25 years ago to nearly 1 million barrels per day, now accounting for less than one percent of global production.

Massive Investment Needed to Revive Venezuela’s Oil Industry

According to energy consultancy Rystad Energy, Venezuela would require at least 15 years and an estimated $185 billion in investment to restore its oil industry to historical production levels.

Demand Raised for Reduction in Packaged Milk Prices

Demand Raised for Reduction in Packaged Milk Prices Marriage Speculation Trends Again After Social Media Interaction

Marriage Speculation Trends Again After Social Media Interaction British Rapper Announces Conversion to Islam During Live Stream

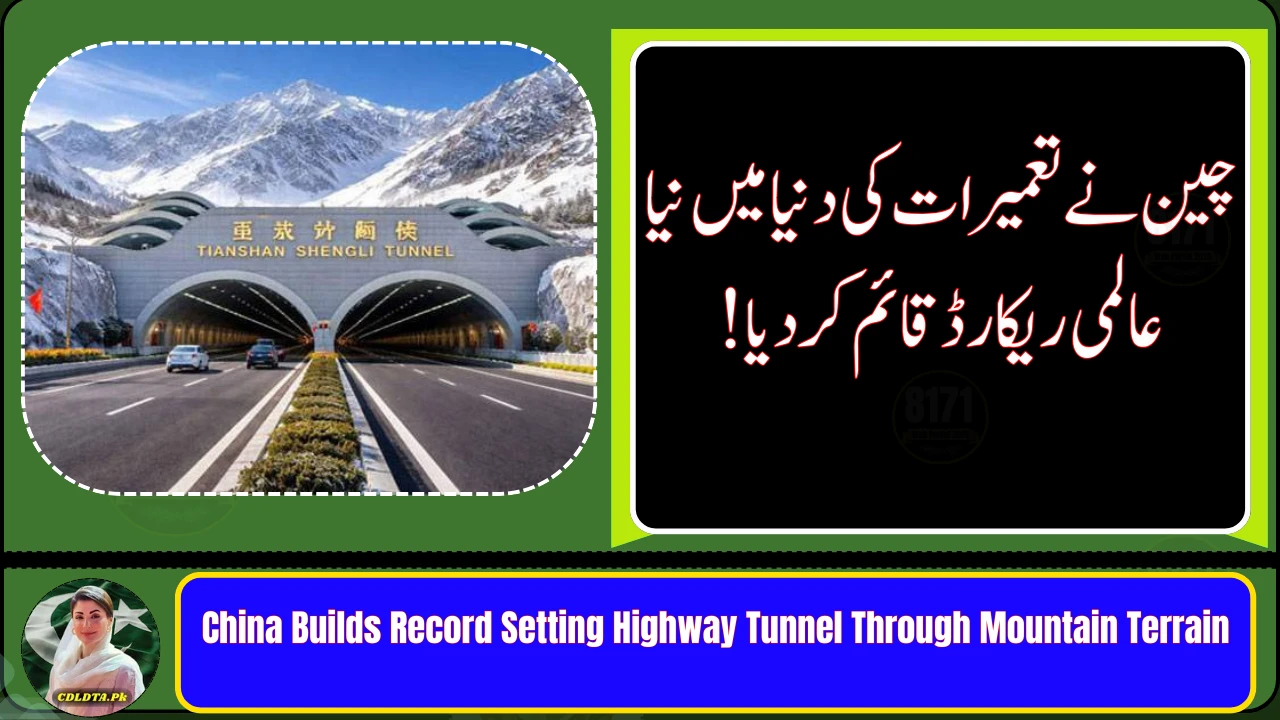

British Rapper Announces Conversion to Islam During Live Stream China Builds Record Setting Highway Tunnel Through Mountain Terrain

China Builds Record Setting Highway Tunnel Through Mountain Terrain Chicken Prices Drop After Festival Buyers See Relief

Chicken Prices Drop After Festival Buyers See Relief Delay in QR and Digital Payments Raises Concerns for Businesses

Delay in QR and Digital Payments Raises Concerns for Businesses